The last time I wrote, it was right after the election. This spending diary is from the first week of the new administration, but I stared at it in my Notes app for a long time before I could fully flesh it out into a post. I don’t really know how people are still writing and still creating through all of this. Probably the secret is to stop trying to drink from the firehose of current events. Probably I’ll learn that lesson eventually.

Wink.

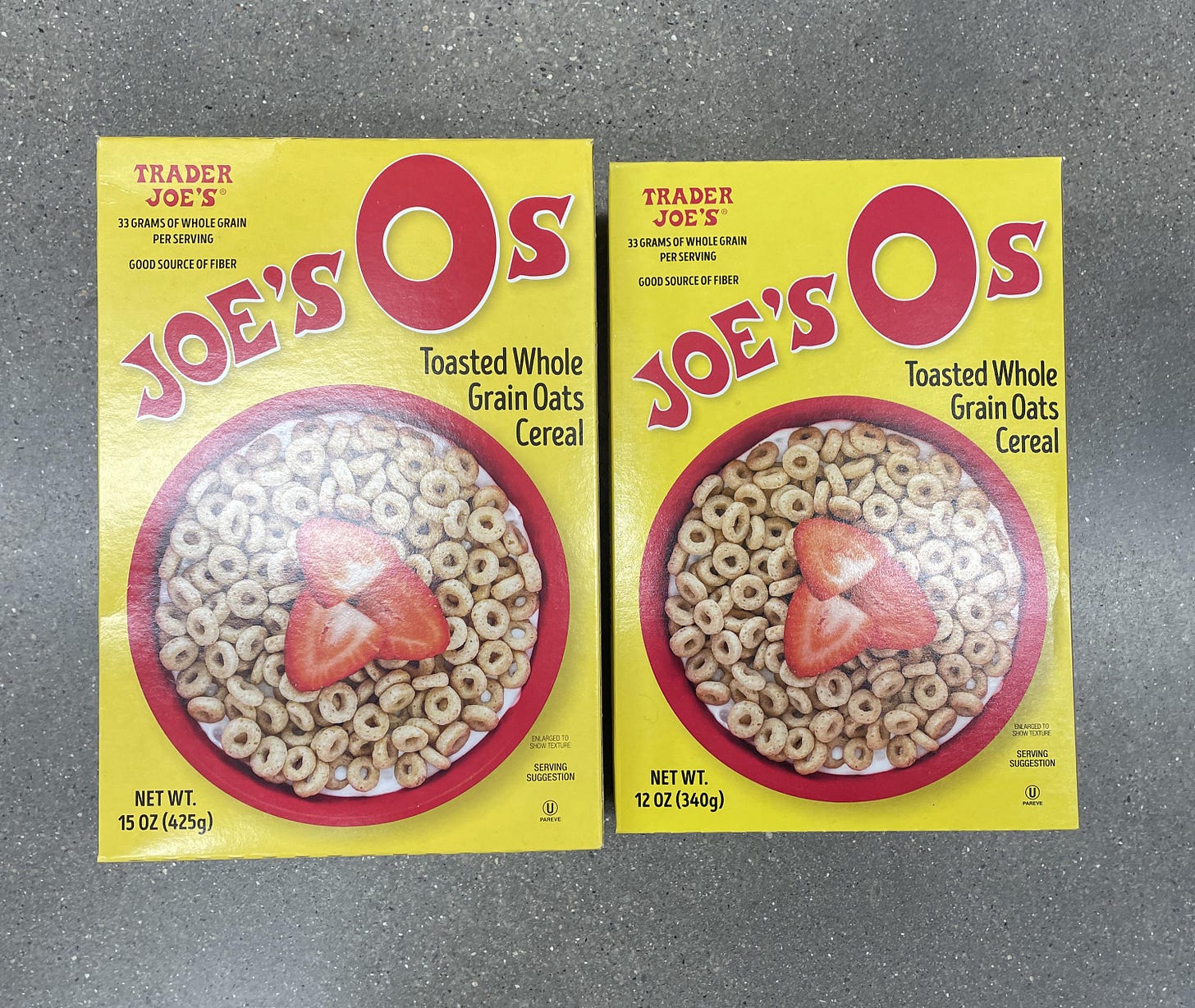

To the surprise of no one, the cost of living is getting more and more expensive for us, but things come in waves. Our electric company gave us a $400.00 grant for low-income families and we’ve been able to put the equivalent of our monthly electricity charges into savings, which is going to help the cost of our car registration when it comes due. I bought a $6.99 box of Cheerios for $1.47 thanks to stacking coupons. (The bougie grocery stores are the only ones open as early as my children wake up ready to eat. Humble Trader Joe’s with their affordable Joe’s O’s doesn’t open until 9 a.m., real matricide hours.) We’re making it, at least for now.

Monday

$0.00, one hour of occupational therapy for two children

$2.83, car charging

$9.00ish, coffee

Today was a school holiday but mercifully still an OT day because the kids go crazy without something to do. Now that it’s winter, the car bleeds charge constantly so we had to plug in at an office park during their appointments. Halfway through charging I had to pee, so my husband told me to order a drink from the nearby coffee shop so I could use their bathroom. Technically speaking, we’re at the point of the pay cycle where we only have the dregs of my paycheck left, but a coffee sounded nice. I used the bathroom while he ordered me a giant mocha that I only drank half of before we had to pick up the kids and I forgot about it and it got cold.

Do you think they’re going to cut Medicaid and we’re going to have to start paying way more for insurance and copays for the multiple weekly appointments we take our children to so they can learn skills that can address the gaps their disability causes? Asking for a friend. lolsob

Tuesday

$14.84 for morning groceries

We’re coming off a month of someone in the house being sick and our routine is still really suffering from it. Laundry, grocery shopping, and cleaning are all sort of piled up. I had to run to the store before work to get eggs for my husband, milk for the kids, and a tiny chocolate milk for myself.

I know the price of eggs is a talking point on both sides of the aisle right now, but can I just say that $5.99 a dozen is genuinely distressing to us? We’re switching to oatmeal breakfasts for a bit until things calm down.

$20.00 to reload car charging account ($9.20 of which was used immediately)

Once I get to work, the car needs to be charged again, even though I drove without the heater and cycled the defroster on only when it was so foggy I couldn't see through the windshield. My options are to pay at the most expensive charger in town or go plug in somewhere after work. Who has time! I decide to pay and get a warning when I open the app that I need to reload my account or my charge may not finish. I fork over $20.00 that will absolutely overdraw our checking account, but tomorrow is payday so hopefully it won’t be for long.

Wednesday

I woke up to EIGHT automated emails from the bank about my accounts being overdrawn. The checking account I was expecting. Our secondary checking account that we use to autopay bills I was not expecting. Looks like I forgot that I paid for a weekly trial to Prime to save on shipping that has now renewed for a month. Tricky tricksters.

Our lovely bank doesn’t charge overdraft fees, instead they give you up to $250.00 of wiggle room before they start declining your card. In the absence of having a credit card, this feature can be useful, although it’s one that we try to avoid.

$4.34, Starbucks

Okay, yes, the accounts are overdrawn, but I forgot breakfast on the way out the door. And then I remember I have a free drink and some gift card money that’s still sitting on my Starbucks card from the month of all of us being sick. I grab egg bites and a tea to hold me over until lunch.

+$2,078.88, bi-monthly paycheck

Fortunately by 10:00 a.m. my bank has credited me for my paycheck, two days early, and all of our sins are washed away. I put $741.00 for half of our rent into the rent account, and $9.00 in the bills account for an iCloud storage subscription and a podcast Patreon pledge. I transfer $44.61 into savings so that we have an even $1,000.00. I go online and pay $8.84 for the X-ray I had to take to confirm pneumonia a couple of weeks ago.

$58.32, groceries

$8.44, McDonald’s for the kids

$6.58, rental for a movie night

After work we get groceries. Well, my husband gets groceries. I can’t tell you what they are because I’m standing with my son looking at every new Squishmallow in the Valentine’s Day section. When we’re getting into the car, our daughter asks for McDonald’s and because it’s late and the kids are both cranky and hungry, we stop by the drive thru on our way home. Once they’re asleep, we rent Heretic, which we’ve both been meaning to watch since the trailer came out. The actors were great, the script had some interesting ideas, but it didn’t really cohere in the end. It was worth exactly $7.00. This is why we watch movies on our couch and not in the theatre.

Thursday

$25.66, morning groceries

Somehow there are two new emails from the bank saying we’re overdrawn even though we aren’t anymore. Great jolt of adrenaline to start the day with. Not participating in the grocery shopping last night means I didn’t remember that I would need a lunch for work. I stop by the boogie grocery store before I go to the office and grab two Amy’s frozen dinners (on sale), a tiny bag of chips, a bottle of chocolate milk (cheaper than Starbucks), some breakfast bars, and a bottle of ibuprofen for my desk.

$9.56 from the car charging account

Then I have to plug my car in again, because of course I do.

$62.76 Trader Joe’s

After work, I grab all the staple groceries we can’t get elsewhere. Mini pizzas that keep my children alive, another gallon of milk, apples and raisins for oatmeal, hummus and cucumbers, yogurt, protein muffin cups for emergency work breakfast, and chocolate almonds and peanut butter cups for treats.

Friday

$5.48 pharmacy snacks

Even though I’ve fully stocked my office with both breakfast and lunch supplies, I stop on my way to work at the drugstore for another chocolate milk and a bag of lime chips. Happy Friday to me.

$5.28 round up to savings

$6.00 surprise transfer

My bank chunks some money into savings for me and I rode the high of feeling like our finances are in order again straight into the weekend.

Elsewhere:

Planet Money on TikTok: What if you owed negative taxes?

Turns out there’s a word for the thing that keeps happening to us as we make more money and lose aid: a benefit cliff.